In this article, i’ll be exploring the importance of signalling. We’ll look at how humans over time have used signalling and how it has evolved in the age of software. More specifically i’ll be exploring signalling in credit cards and how credit cards have long been a status symbol.

If we look back in time, humans have signalled status in all the different ways possible.

The monarchs of Britain signalled status with their huge Buckingham Palace and dozens of servants. Politicians in India signal status with the ‘lal batti’ on their cars. More recently humans prefer to use luxury goods to signal status. Whether it’s a Gucci bag or a Rolex watch. And for those of us who can’t prefer any of these luxuries, we signal status using the iPhone. Even if it costs us a kidney in the process.

Research indicates there are 4 segments based on their wealth and their need to signal status.

Segment A: Wealthy and a low need to signal status

Segment B: Wealthy and a high need to signal status

Segment C: Poor but a high need to signal status

Segment D: Poor and a low need to signal status.

Segment B: Wealthy consumers in high need of status use loud luxury goods to signal to the less affluent they’re not one of them. An apt example is someone who drives a Porsche in India. Very often people who’ve recently become rich tend to have a high need to signal status in an effort to fit in.

Segment C: Consumers who are in high need of status but can’t afford luxury goods often use counterfeit goods to emulate the wealthy. Have you seen the number of people on Linking road or Palika Bazaar buying look a-likes of famous outfits or merchandise? That’s people trying to emulate the rich.

The scale of wealth doesn’t need to be a binary — rich or poor. It’s more of a spectrum and different sub-segments can be defined based on wealth.

Credit Cards and Signalling

Some of the oldest players in the Credit Card space have long understood the use of branding Credit Cards as status symbols. The best among them Amex which built a multibillion dollar empire by telling its user they were special. And that their card symbolised this special status. It set you apart from the lesser mortals who didn’t own one.

The best article i read on this is the NYTimes article about the rise of Chase Sapphire with the perfect title — ‘Amex, Challenged by Chase, Is Losing the Snob War’. While Amex differentiated themselves by telling its users they were better than others, Chase Sapphire went after fulfilling the motivations of a new age of users. Users who cared less about being rich and more about being cool. Newly rich software engineers for example. Validation was as necessary to these users as it was for the previous set, however it was now expressed via social media. In the form of travel to exotic places and restaurants. Eugene Wei wrote a very important article on ‘https://www.eugenewei.com/blog/2019/2/19/status-as-a-service' Status as a service and how it has evolved from just being a display of wealth.

Julian Lehr’s blog post motivated me to write about some of the thinking that went behind in designing some of our own products.

Metal Card as a way to signal status

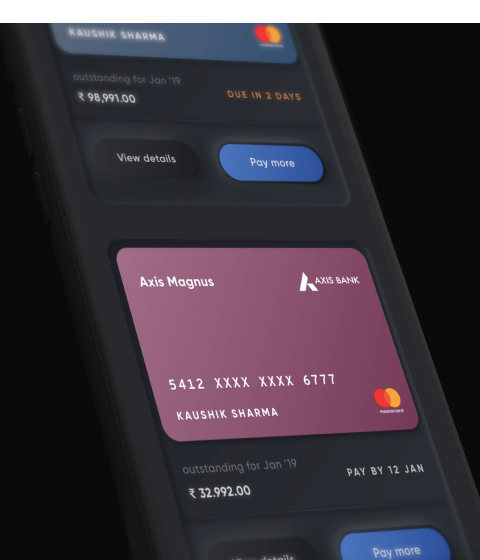

How does a credit card signal it’s different? One big way is the design. And credit card companies have used it to differentiate their offerings with the luxury cards having a more sleek and minimalistic look. The other more recent phenomenon is a metal card.

It’s a wow creator for both the users and merchants. Users love the ‘heavy card’ in their hands. And they love to show it to their friends. And every time you pay it at the merchant, the merchant is astounded by this new heavy and sleek looking card in their hands. A classic way to signal status.

As we explored in the previous paragraph, a big part of signalling for the current generation of users is social media. And the best part about having the card number at the back — you can show off your card on social media. Made a new purchase — show it off! Just got your new card — show it off.

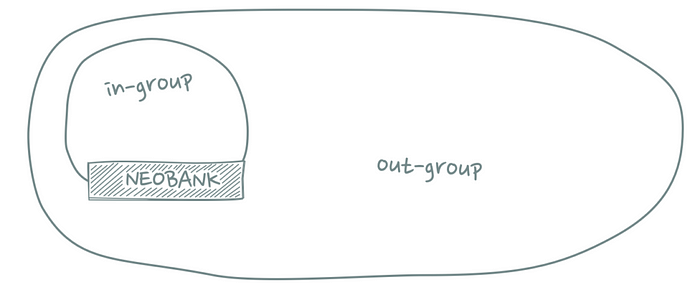

Exclusion — a big part of signalling

A big part of signalling is exclusion and scarcity. The Prada bag is great because only a ‘select few’ can afford it. The Porsche signals status because they’re scarce on the roads and every time you spot one it grabs your attention.

One of the advantages of the India Market is its sheer size. Currently there are 60m outstanding cards in the Indian market with an average user expected to have 2 cards. Thus only about 30m unique users have a credit card. And the number of users with a credit record is a huge 250m(last reported to be 220m with an expected addition of 15m users each month). Thus most neocards are just getting started.

This brings us to the important question.

Can software itself be used for signalling?

In Julian’s blog, the agreed consensus was that software was at a disadvantage because you couldn’t use it for signalling. But i beg to differ. And companies in India and abroad have shown us that software can in fact be a powerful way for signalling.

Cred(the app everyone loves to comment on :)) — in a mind bending view point for some has adopted a new trend — Neumorphic design. While some might agree that it makes the app difficult to use, it serves a different purpose. It’s different. From all the flat apps out there. It’s the ‘Lamborghini’ of cars or the ‘Rolex’ of watches. And in its own ways, it’s convinced users that simplicity isn’t everything.

Credit Cards have a ton of other ways to signal status. Lounges, memberships, invites to exclusive sessions, passes to luxury hotels and sports championships among others.

What are the quieter ways to signal status for users with extreme wealth but low need of status? What are the ways to signal status for a large number of users(majority of India) that doesn’t have a lot of wealth but a high need to signal status? What are the ways to signal ‘coolness’ without signalling wealth? All of these segments are huge credit card products and i’m excited to see how this plays out over the next 10 years.

What are the other examples of using software to signal status?

Will software democratize access(Clubhouse let’s you listen to Marc Andreesen) to such a great extent that companies will have to find newer ways to signal status?

I’m curious to learn more from you’ll. If you found the article useful, please feel free to hit the share with your friends.

I’m a product builder currently re-defining credit in India. If you’re interested to work with us, please DM me here or on Twitter. I love all things consumer — fintech, social, video and music. Farnam Street explores more generally the different ways we signalling. You can read it here.

From: https://www.jstor.org/stable/27800823?seq=1 — Research on segments.